In this article, we’ll delve into the current state of Bitcoin, the upcoming halving event, the concept of dollar cost averaging, and some noteworthy developments in the crypto market.

(This post is from our series of Facebook Lives. Catch the next one on our Facebook channel.)

First, before we get too far, this blog post may contain links to products that we have tried and liked. If you click on the link and make a purchase, we may earn a small commission, which does not increase the price for you nor directly affect whether or not we recommend the product. (We’ll even tell you which products we DIDn’t like and let you make your own evaluations!)

Introduction

Welcome to our weekly crypto investing discussion where we explore the world of cryptocurrencies and share strategies to make safer investments. This week has been particularly interesting in the crypto space, with Bitcoin experiencing significant price fluctuations.

Bitcoin’s Rollercoaster Ride

As seems usual these days, Bitcoin’s price has been the subject of even more speculation and predictions recently. Some experts suggest that if Bitcoin fails to rise past a certain line, it could drop to around $20,000. Presently, it is hovering around $25,000, making it a potentially good time for investors who prefer buying during a dip. However, accurately timing the market remains a challenge, as it’s impossible to predict how low prices could go.

The Anticipated Halving Event

Another topic of discussion is the upcoming halving event in the crypto world. This event involves reducing the rate at which Bitcoin is mined and rewarded by half, resulting in increased scarcity. The anticipated scarcity is expected to drive up Bitcoin’s value since obtaining it becomes more challenging. Some people are proclaiming that the value of Bitcoin will increase greatly after the Halving event, but there’s no way to know for certain at the moment.

The Potential for Great Returns

The crypto market is known for its volatility, with Bitcoin’s price experiencing significant fluctuations. In the last two years, it soared to nearly $70,000 and then quickly plummeted to as low as $16,000. Despite the rollercoaster nature of the market, there are predictions that Bitcoin could reach $140,000 in the near future. Imagine buying Bitcoin at $25,000 and selling it at $140,000 in 2024 – a substantial return on investment. However, it’s important to note that crypto markets are highly unpredictable, and a “buy and hope” approach is not recommended.

The Importance of Long-Term Investment

For those considering crypto investments, it’s crucial to be prepared to hold onto them for several years. Bitcoin has demonstrated a history of paying off in the long run. However, if you bought Bitcoin at its peak (around $70,000) in November 2021, you would still be holding onto a losing asset almost two years later, with the price currently back at $26,000. The emotional challenges of timing the market are no small matter.

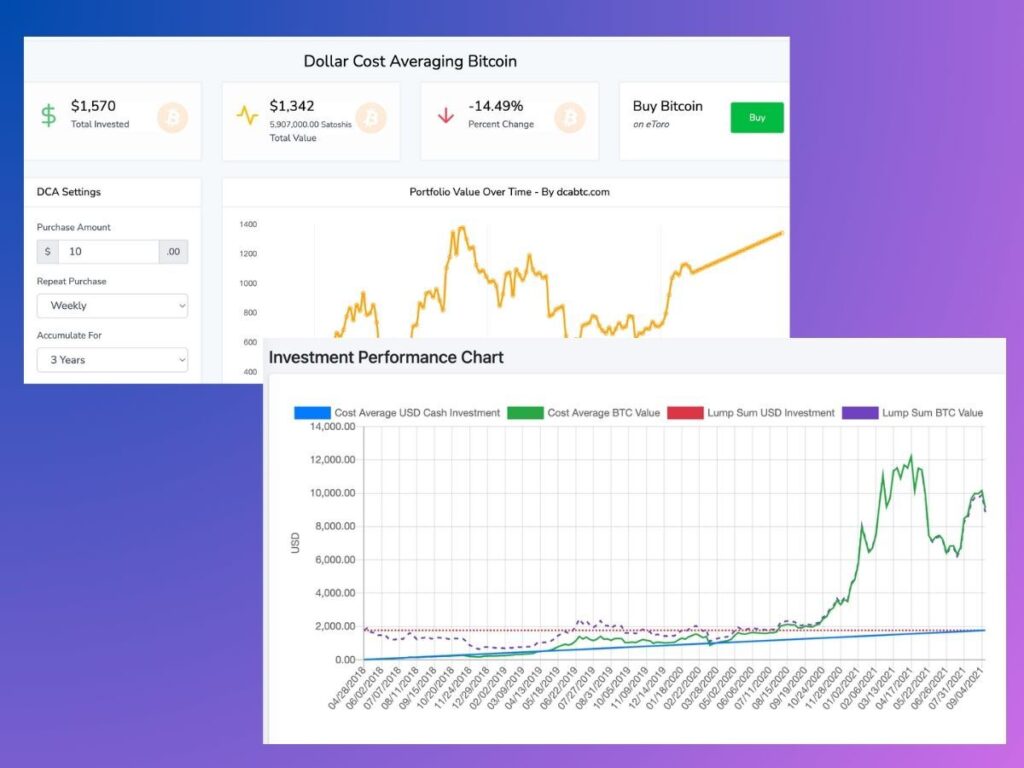

The Strategy of Dollar Cost Averaging

One strategy that we often discuss in our videos is Dollar Cost Averaging. This disciplined approach involves investing a fixed amount of money into Bitcoin consistently – preferably daily or weekly. By doing so, you buy Bitcoin at different price points, benefiting from both higher and lower prices. This method helps remove the emotional aspect of investing, providing a significant advantage.

Read more: Even the Motley Fool thinks it’s smart to invest in Bitcoin through Dollar Cost Averaging! Why Dollar-Cost Averaging Into Bitcoin Is ??the Best Strategy

A Reliable Option for Dollar Cost Averaging: Swan Bitcoin

To simplify the dollar cost averaging strategy, you can automate the process using platforms like SwanBTC. With Swan Bitcoin (affiliate link), you decide the daily or weekly amount that you want to invest. Swan then withdraws a weekly amount of cash from your bank account so that they can purchase a set amount of Bitcoin for you on the schedule that you’ve decided. This set-and-forget approach eliminates the stress associated with market fluctuations and allows you to focus on other projects and long-term investment goals.

Considering Ethereum and Other Cryptocurrencies:

While dollar cost averaging is often associated with Bitcoin, it can be applied to other cryptocurrencies like Ethereum as well, especially if you are not disciplined enough to follow through with your intended regular investments. However, most exchanges may charge additional fees for this service. Therefore, finding a cost-effective option is crucial when considering dollar cost averaging with alternative cryptocurrencies.

Keeping an Eye on Developments

The crypto world is full of surprises, with memecoins like Dogecoin defying expectations and maintaining attention. Another cryptocurrency to keep an eye on is XRP, especially with the recent positive developments in its case with the SEC. In addition, the potential for more crypto ETFs is solidifying as courts overturn the SEC’s attempts to block these investment vehicles. However, it’s important to remember that ETFs may not perfectly mirror crypto’s price swings and come with their own drawbacks.

Conclusion

Crypto investing is undoubtedly a wild ride, with market timing proving to be an immense challenge. Dollar cost averaging offers a more reliable strategy for those who want to invest without constantly monitoring the market. It’s crucial to stay informed about developments like the emergence of ETFs while exercising caution and conducting thorough research before entering the crypto market. We’re here to answer your questions and provide guidance, so feel free to reach out. Enjoy your crypto journey and have a great Saturday!

Our favorites Dollar Cost Averaging (DCA) info sites are:

For Bitcoin: https://dcabtc.com/

For other cryptocurrencies: https://dcacryptocalculator.com/

Interested in Bitcoin DCA? Our favorite company is Swan Bitcoin (affiliate link).

This blog post contains affiliate links. If you click through any links and purchase something, we may earn a commission at no cost to you.

Did you read our previous post about crypto strategy titled: “Diversification and Safety Tips: What Works When You Are in Crypto”.

Find out more about this week’s topic by listening to our Audio Podcast and watching our YouTube video below.

Leave a Reply